Suraksha Diagnostic IPO Details

IPO Date: 29th to 3rd December, 2024

Total Issue: ~ Rs. 846.25 Crores

Price Band: Rs. 420 – Rs. 441 per share

Lot Size: 34 shares and multiples thereof

Purpose of Issue: Offer for Sale

Company Overview

Suraksha Diagnostic offers a one-stop integrated solution for pathology and radiology testing, as well as medical consultation services, to customers through an extensive operational network consisting of the company’s flagship central reference laboratory, eight satellite laboratories, and 215 customer touchpoints, including 49 diagnostic centres and 166 sample collection centres. During FY24, the company conducted ~5.98 million tests, serving around 1.14 million patients and deriving 95.48% of its total revenue from its core geography—Kolkata and the rest of West Bengal.

The company’s radiology equipment includes 24 CT and 13 MRI machines. Its market share in Eastern India stood at 1.15–1.30% in FY24. The revenue split between major segments in FY24 was radiology (46%), pathology (53%), and the remainder from doctor consultation services (via polyclinic chambers). Suraksha Diagnostic’s B2C segment contributed 93.83% of its revenue in FY24.

Industry Overview

The domestic healthcare industry is currently valued at Rs. 9.5–10.5 trillion (tn). By FY28, the industry is projected to grow to Rs. 14.5–15.5 trillion, achieving a CAGR of 10–11%. This growth is anticipated to be driven by factors such as an aging population, an increased incidence of lifestyle diseases, growing healthcare awareness, technological advancements, and a burgeoning affluent middle class.

As of FY24, India’s diagnostic industry was valued at Rs. 860–870 billion (bn) and is projected to grow to Rs. 1,275–1,375 bn by FY28, registering a CAGR of 10–12% between FY24 and FY28. This growth is expected to be driven by rising literacy rates and increasing disposable incomes, leading to greater awareness and demand for quality healthcare services, including diagnostics. Additionally, growing urbanization, coupled with lifestyle-related diseases and an aging population, will further amplify the need for accurate and timely diagnostic services to effectively identify and manage health issues.

Among diagnostic services, radiology is projected to grow at a faster pace, with a CAGR of 11–13%, compared to pathology services, which are expected to grow at 9–11% over FY24–FY28.

Objects of offer

The company will not receive any proceeds from the offer, as all proceeds will go to the selling shareholders in proportion to the shares they sell as part of the offer. The promoters' shareholding is expected to decrease from 82% to approximately 45% post-IPO.

Strategic Initiatives

- Strengthening core business: The company is focused on strengthening its position in its core geography, i.e., Kolkata and the rest of West Bengal. Its diagnostic centres are primarily located in the urban regions of Kolkata. To capitalize on its existing brand equity, the company plans to expand operations into the suburban regions of Kolkata. Its newer centres in southern Kolkata are yet to reach their full capacity.

Revenue growth will also be augmented through medical consultation services offered via polyclinic chambers at diagnostic centres. The company aims to achieve this by establishing more polyclinics within existing diagnostic centres and increasing the number and specialties of doctors associated with the company. - New Business: The company is working to expand beyond its core market into adjacent geographies in eastern and northeastern India. In 2019, it extended its operations to Meghalaya by entering into a memorandum of understanding (MoU) for a public-private partnership with the Department of Health and Family Welfare, Government of Meghalaya, to establish a high-end diagnostics facility. While expanding into these regions, the company intends to replicate (a) the ‘hub and spoke’ model to unlock economies of scale and (b) the polyclinic model to drive a higher number of patient footfalls into its centres.

- The company is also working to increase its revenue by establishing B2B and corporate partnerships. It provides services under the West Bengal Health Scheme within West Bengal and the Central Government Health Scheme for patients across West Bengal, Bihar, and Assam. Additionally, the company has enrolled with the Employees' State Insurance Corporation to deliver super-specialty diagnostic services to its beneficiaries in West Bengal.

- Acquisition: To supplement organic growth, the management plans to pursue selective acquisitions and/or strategic partnerships with local diagnostic centres across eastern and north eastern India. For example, in 2020, the company acquired two pre-existing diagnostic centres in Kolkata from Future Medical and Research Trust.

Risk Factors

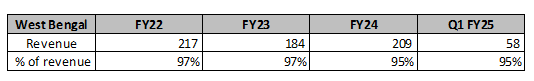

- Geographical concentration risk: The company operates across 12 cities and towns in India, spanning the states of West Bengal, Bihar, Assam, and Meghalaya. However, a significant portion of its operations is concentrated in West Bengal, which accounts for 95% of total revenues. As a result, any regional slowdown in economic activity, political or civil unrest, disruption, disturbance, or economic downturn in West Bengal could adversely impact the company's business.

- History of infractions in the past

- The company provided a guarantee of Rs. 67 crore against personal loans taken by its promoters.

- It failed to present financial statements before the AGM, file financial statements with the Registrar of Companies (ROC), and submit company secretary-certified financial statements.

- It also failed to appoint a whole-time Company Secretary.

These offences have since been compounded (settled) by the relevant adjudicating officers, and the associated penalties have been paid.

Peers

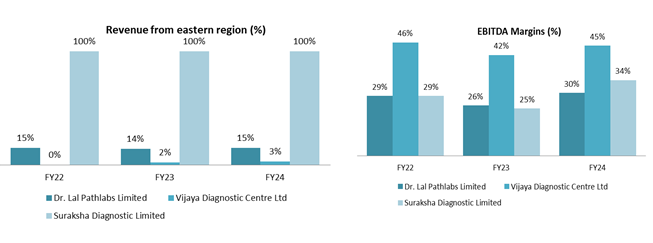

- In terms of EBITDA margin, Suraksha Diagnostic achieved 34% margin, making it the second highest, following Vijaya Diagnostic, which leads with 45%. These margins are higher due to the more number of centres, which allows for better absorption of fixed costs and better mix of mature centres. Additionally, the mix of B2C operations is higher for Suraksha as well as a Vijaya at ~ 94% of the revenue as compared to Dr. Lal Pathlabs.

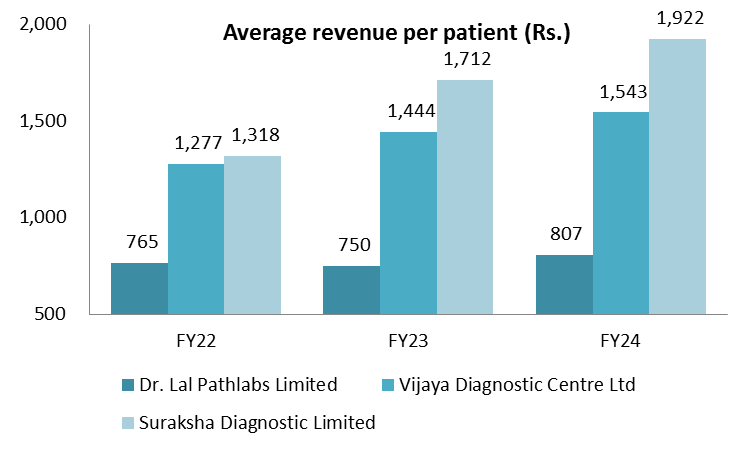

Among its peers Suraksha Diagnostic recorded the highest average revenue per patient in FY24, amounting to Rs. 1,922. Revenue per patient is higher because of the geographical concentration and network density effect.

Financials

- Revenue increased by 15% to Rs 219 crores in FY24 from Rs 190 crores in FY23. This growth was driven by a 3% increase in the number of patients served and a 12% increase in revenue per patient. The revenues for FY22 appear substantial due to the impact of COVID-19 testing; therefore, the comparison is made between FY23 and FY24.

- The EBITDA margin expanded from 28% in FY22 to 32% in FY24. This expansion was achieved due to an increase in the number of centres, which allowed better absorption of fixed costs.

- The company has a healthy balance sheet and is almost debt-free, resulting in minimal interest costs.

Management

Dr. Somnath Chatterjee is the Chairman and Joint MD of the company, and is currently responsible for overall planning and business strategies of the company. He is registered doctor with the West Bengal Medical council and also holds a bachelor’s degree in medicine and surgery from University of Calcutta in 1985. He has been associated with the Company and Suraksha Diagnostic & Eye Centre Pvt Ltd since their incorporation and has more than 32 years of experience in the field of medical and diagnostics business.

Ritu Mittal is the Joint MD and CEO of the company, and is currently responsible for end to end operations of Suraksha Diagnostic. She holds a bachelor’s degree in commerce from the University of Calcutta and has more than 28 years of experience in the field of medical and diagnostics.

Satish Kumar Verma is a Non-Executive, Non-Independent Director of the Company, and is currently responsible for strategic planning and customer relationship management of the company. He obtained his bachelor’s degree in mechanical engineering from Punjabi University in 1969 and post-graduate diploma in engineering from Punjab University in 1971. He has more than 40 years of experience in management. He is currently a director with Kanika Audio Visuals Pvt Ltd.

MoneyWorks4me Opinion

The Indian diagnostics industry is projected to grow at a healthy CAGR of 10–13%. While the East Indian market is relatively smaller compared to other regions, major players have limited presence there. We appreciate Suraksha Diagnostic for its:

a) Potential for growth in West Bengal, leveraging existing hubs.

b) Strong margins with plans for further expansion.

c) Presence in East India, where revenue per patient is relatively higher.

Management has indicated plans to:

a) Achieve 15–20% growth through inorganic acquisitions, doubling the number of centers within three years, and implementing price hikes every alternate year.

b) Expand EBITDA margins by capitalizing on economies of scale.

The company is being listed at a P/E ratio of ~100x. At such lofty valuations, the risk of maintaining similar or better margin profiles during expansion into other states is underplayed. Therefore, we recommend avoiding subscription to this issue, given the unfavorable risk-reward balance.

On another note, we have been bullish on the healthcare sector for a while now and made handsome returns across 3 companies. To see our other recommendations, please check out Superstars Amplified plan.

Suraksha Diagnostic Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | November 29, 2024 |

| IPO Close Date | December 3, 2024 |

| Basis of Allotment Date | December 4, 2024 |

| Refunds Initiation | December 5, 2024 |

| A credit of Shares to Demat Account | December 5, 2024 |

| IPO Listing Date | December 6, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 34 | Rs. 14,994 |

| Maximum | 13 | 442 | Rs. 194,922 |

Suraksha Diagnostic Limited IPO FAQs:

When will the Suraksha Diagnostic Ltd IPO open?

Suraksha Diagnostic IPO will open for subscription on Friday, November 29, 2024 and closes on Tuesday, December 3, 2024.

What is the price band of Suraksha Diagnostic Ltd IPO?

The price band for Suraksha Diagnostic Ltd IPO is Rs. 420-441/share.

What is the lot size for the Suraksha Diagnostic Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 34 shares, up to a maximum of 13 lots i.e. Rs. 1,94,922/-.

What is the issue size of the Suraksha Diagnostic Ltd IPO?

The total issue size is ~ Rs. 846.25 Cr.

When will the basis of allotment be out?

Allotment will be finalized on December 4th and refunds will be initiated by December 5th. Shares allotment will be credited in Demat accounts by December 5th.

What is the listing date of Suraksha Diagnostic Ltd's IPO?

The tentative listing date of the Suraksha Diagnostic IPO is December 5th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: